Library

Library

Accounts

...

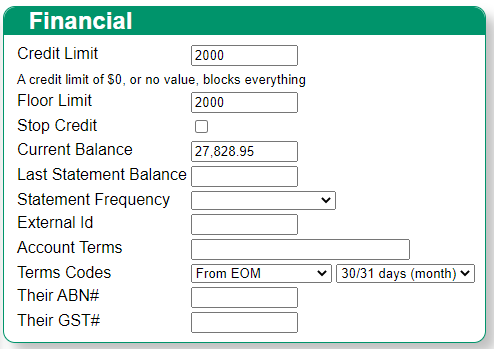

Financial Controls

- Credit Limit The credit limit defines the maximum outstanding balance for an account. When this threshold is exceeded new sales receive messages stating over credit limit. What happens next depends on system configuration.

-

Floor Limit This sets the largest single charge that can be applied as part of one sale. The POS only considers that single sale and nothing stops another sale

being entered immediately afterwards. ie floor limit is per transaction, not per day.

Both credit limit and floor limit need to be specified, no value (blank) is taken as zero which means $0, not unlimited. If you don't wish to use credit and floor limits the easiest solution is to enter a large amount, effectively disabling them.

- Stop Credit When ticked, the account is blocked from placing any new charges on the account.

- Current Balance, Last Statement Balance These values show the current position. You cannot alter these values here.

- Owning Application Sets the owner of the account to be the application that has ultimate authority over the account. See below

- Statement Frequency How often do you wish to generate statement for this account. This is the frequency at which statements

can be generated, it is not automatic you still need to check and run statements.

If you choose "Weekly, Tuesday" then when you view the statements page on a tuesday, the account will show as due for a statement if the account has a non zero balance. If the account had a zero balance on Tuesday, charges a sale on Wednesday, and you view statements due on Thursday, then this account will not show until next Tuesday. If you don't run statements on [next] Tuesday, then the account will show on any day until a statement is generated.

Day Tuesday Wednesday Thursday Friday Saturday Sunday Monday Tuesday Wednesday Thursday Balance $0 $50 $50 $50 $50 $50 $50 $50 $50 $50 Statement Due No No No No No No No Yes Yes Yes If the frequency is set to "After Sale, N days" then the account becomes due N days after the oldest sale. At this time all outstanding sales are included. Example, if set to "After Sale, 7 days"

- Opening balance is $0

- Sale created on the 22nd.

- Sale created on the 24th

- On the 29th (22 + 7) the statement becomes due. The statement includes both sales.

- External Id A reference number used for external systems. This value is not used directly by Fieldpine. Accounts that are linked to MYOB, Xero or other integrated accounting systems have their own fields and do not store here.

- Account Terms Human readable description of account terms. These would typically be printed for the customer to see

- Terms Codes Internal processing rules for terms. These provide technical definition of the terms for Fieldpine reports.

- From EOM The base processing date is derived from the oldest sale on the statement, and then moving that to the 1st of the following month. eg a statement run on 7 August, containing a sale from 4th of April (note, multiple months) will use a processing date of 1st May

- From Sale (invoice) The base processing date is derived from the oldest sale on the statement. eg a statement run on 7 August, containing a sale from 4th of April will use the 4th of April as the processing date

- From Statement The base processing date is derived from the date of the statement. eg a statement run on 7 August, containing a sale from 4th of April (note, multiple months) will use a processing date of 7th August

Once a base processing date is selected, it is then adjusted or offset by the associated number of days

- Their ABN#, Their GST# Customer values, sometimes used on receipts and statements.

Owning Application

If you are using multiple applications, such as Fieldpine and an accounting system like MYOB (etc), then one application must be "in charge" of the account or "the authority". The authority for the account means

- That application is used to make changes to the account definition, and these typically flow into Fieldpine

- Current balance information is read by Fieldpine from the authority periodically. They are the account authority, they have the correct balance at any point in time

- The authority generates statements for the account, as only they can be certain of having all transactional information

In general, if you have integrated accounting systems we recommend that they are the authority for accounts. If you do not, you will need to be extremely diligent that all transactions entered against the account in the accounting system are also entered into Fieldpine. Fieldpine does not read or understand every transaction that can be applied in accounting systems. Specifically, if your accounting system automatically reads your bank account and applies payments, Fieldpine will not see that payment.

Our interfaces to accounting systems are geared around sending all transactional details to the accounting system. However, if you are careful to ensure all financial transactions are entered into Fieldpine, then Fieldpine can remain the authority.

Account Terms

Account terms define the conditions the customer must adhere to for the account. Terms outline payment requirements. The frequency at which you send statements is separate to terms, even though many terms may imply a statement frequency.

When producing statements the following symbols are available

Generated Terms Code

When terms codes are automatically generated the following shows what will typically be produced. The value in red shows typical output for a sale entered on 5th May. If multiple sale dates exist on a statement, the first date in calendar order is used.

| Not Specified | 7 Days | 14 Days | 20 Days | 30/31 Days (month) | |

| None | |||||

| From EOM | 7-Jun-2022 | 14-Jun-2022 | 20-Jun-2022 | 30-Jun-2022 | |

| From Sale (Invoice) | 12-May-2022 | 19-May-2022 | 25-May-2022 | 5-Jun-2022 | |

|

From Statement Where statement produced on 1st of June |

7-Jun-2022 | 14-Jun-2022 | 20-Jun-2022 | 30-Jun-2022 | |

|

From Statement Where statement produced on 12th May |

19-May-2022 | 26-May-2022 | 2-Jun-2022 | 12-Jun-2022 |